Insurance technology structured around custom user-behaviour is no-doubt the next chapter for insurance sector. The possibility of curbing the risk by making decisions entirely based on concrete data provides a big financial boost to the companies. Enacting the role of a torch-bearer for this change are the tools like Usage-based insurance (UBI). Carrying the in-vehicle telematics set-up in its heart, UBI does the work of delivering more accurate customer risk profiles by closely monitoring driving behaviour. It’s a technology which certainly has a lot to offer, and if used in the correct manner, it can not only provide true risk level associated with a driver’s profile, but also the detailed insights can instigate a deliberation over the company’s price models. The system has the ability to suggest ideal price point that will generate maximum revenue for the organization. Nevertheless, it’s hardly that simple. Most of the insurance companies out there are not equipped to turn raw data into a piece of actionable information. Furthermore, a lot of other stuff goes into creating a packed risk profile of a driver. eDriving boasts an arrangement that irons out these issues and many others holding similar relevance.

While the common set-up offers only unrefined data, leaving the insurance companies to interpret it in their own way, eDriving goes a step ahead by actually guiding the companies in reducing the risk factor through the concept of Risk Managed Insurance (RMI).

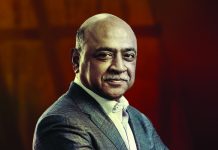

‘We have spent over 20 years refining our patented approach with some of the world’s largest fleets and insurance partners. This approach allows us to transform these complex data sets into actionable information for both insurance providers and their customers. Using a combination of leading indicators obtained from telematics as well as traditional data sources such as MVR/license checks and collision data, we create a holistic view of risk, ’ explains the founder and CEO of eDriving, Ed Dubens.

eDriving, as an organization, forayed into the industry in 1994 as eDriving FLEET (formerly interactive driving systems). Since then, the company has evolved on the basis of Total Quality Management, and continuous improvement. A lot of this evolution has been directed towards remedying the driving risk management issues. Once they were well into their journey and armed with some experience, the company created a patented methodology, originally covered under the wing of their Virtual Risk Program. Like the company itself, this methodology has also walked through a string of transformations. From a basic CD-based delivery platform, it has now grown into a fully encrypted risk management program. The program is available online, across 7 continents and accessible in more than 45 languages.

‘Today, we combine our patented approach with the latest in-vehicle telematics devices, proven behavioural change, risk reduction techniques, successful micro-learning, and gamification elements to provide an integrated smartphone-based driver risk management solution, Mentor by eDrivingSM,’ states Ed Dubens.

With its unique data collection abilities and research-based analytics engine, Mentor by eDriving has emerged as a perfect platform for insurance providers to construct their UBI and RMI programs on. eDriving’s reliable methodologies partnered with Mentor’s competence as whole have created a blend that promises to breathe life into the insurance sector. Unlike many other short-range price-cutting tactics, this philosophy of eDriving looks like it’s here to stay.

In their pursuit of excellence, eDriving has gone well beyond the boundaries of telematics. Changing the game through solutions that only detect the issue but also assist you in solving it, i.e. Mentor provides in-app micro-training modules to coach safe driving to the drivers, it’s appropriate to say that the company has touched a new benchmark.