As technology continues to evolve and influence virtually every part of our lives, the collision repair industry sector and car owners are experiencing a particularly interesting challenge. Customer expectations are changing quickly and the process for getting damaged cars repaired and safely back on the road is becoming increasingly complex and costly. Today’s drivers are travelling fewer miles due to travel restrictions, which is good news for insurers. Fewer miles driven usually means fewer accidents. But recent studies indicate that cars are traveling at faster speeds because of less congestion on the roads. The result is average claims costs are rising due to their increased severity. More specifically, car repair costs are rising due to the presence of complex driver band technologies like advanced-driver assistance systems (ADAS), electronic vehicles (EV), and diagnostics and calibration needs that make for significant business challenges when compared to eras when automobiles were less complex.

As vehicle technology evolves and improves helping to make lives safer and more convenient, that technology is rapidly changing the already complex repair processes and ultimately producing higher costs. In short, the industry is at a crossroads.

To address these challenges, some of which are the result of complex technologies introduced into automobiles, the industry can look to a different set of technology tools like Artificial Intelligence (AI)for help.

AI can enable faster and better decisions, which results in reduced costs for auto repairs and helps counteract the effect of increasingly intelligent automobiles. However, one of the main barriers to the adoption of AI-based solutions in the repair process is the reluctance of humans to trust the machine, especially when they fear their jobs may be at risk. So how can the car repair appraiser trust the machines to help with this task if they don’t know how AI works and or understand how the AI arrives at its decisions?

Solera— a global leader in data and software services that strives to transform every step in the vehicle lifecycle into a touchless experience—solved that challenge by building AI that users can reason with. For example, by drawing contours around damages in photos from past cases, their data experts are able to train the AI to do the same automatically for every new case. This enables damage appraisers to “see what the AI see” and grow confident to adopt the technology.

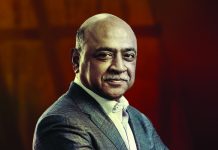

Led by Darko Dejanovic, CEO, Solera is transforming the way insurance and automotive professionals provide value to their customers. Solera is a pioneer in building indispensable AI that automates the damage estimating workflow, reducing claims costs and cycle times while improving overall customer experience for the car owner.

Fueling the Transformation with AI

Today, Solera is a leader in vehicle lifecycle management, touching all aspects of the life of a vehicle. This achievement is powered by the accumulation of decades of data and a history of growth and expansion into segments of the vehicle lifecycle that benefit from data and technology innovations. AI/Machine Learning requires well curated data sets to deliver results with precision and accuracy. This is where Solera’s revolutionary AI-enabled claims platform Qapter comes into the picture. More than2,000 engineers, many of whom are also automotive specialists, help ensure that it produces the best data for machine learning training. Qapter Intelligent Estimating is Solera’s flagship AI product for claims management that uses a one-of-a-kind car repair data science to analyze and produce repair estimates after an accident. Solera also offers Fleet and Dealer solutions built on AI technology that predicts driving behavior or can identify buying intent for a vehicle. Solera’s AI/ML provides the insight to optimize business processes while enhancing the overall customer experience.

Another upcoming trend in the automotive claims industry is the disruption being caused by a new generation of policyholders—millennials— who expect richer digital experiences. They expect immediate and transparent answers to their accident claims and they will value carriers who use technology to do just that. At Solera, the company’s claims platform, Qapter, uses AI at its core and its visual intelligence enables Qapter to detect damage from a single photo in less than one second. This capability means Insurance providers can use AI as a way to help policyholders become a part of a process that is faster where Policyholders can submit several photos via a guided process that produces a repair estimate in less than ten minutes.

When combined with the vehicle database, the claims platform can now render a pre-estimate in three minutes. Time saved from a faster process can now be better used for handling more complex claims that require a skilled accessor. Soon, expediting claims powered by AI will start to accelerate the adoption of straight-through processing or simply put – touchless claims management.

Resolving Everyday Challenges

Everyday insurance carriers are faced with the challenge of spotting damage being claimed that is not eligible for payment because it existed before policy inception. In some global markets, physical inspections are required at the time of underwriting to prevent these situations, however, that process creates inconvenience to customers and additional expenses to carriers. To address these challenges, Solera has developed a simple and intuitive self-service app that helps the prospective policy holder to report the vehicle condition assisted by AI. The service was successfully launched by Asirom (part VIG group) in Romania, allowing customers to perform their own car inspection in less than five minutes for full coverage policies. Besides this innovation, Solera also leverage sits vehicle and claims database to determine if the vehicle has been involved in previous accidents, or if it is equipped with ADAS technology that may affect how the premium is calculated.

While explaining the value Solera can deliver, one of Solera’s customers, one of the largest European insurance carriers, presented a situation where its 400 damage appraisers were responsible for managing over 130,000 claims every year: they lacked consistency in producing repairing or replacing decisions for damaged automobile parts. Many factors are at play here, including training, skills, experience, and, sometimes, biased decision-making. By introducing Solera’s Qapter Intelligent Estimating tool in the claims process, the client was able to transition from a subjective, error-prone approach, to more consistent and efficient damage estimating process.

A Remarkable History of Achievements

Solera’s history began in 1966 when Swiss RE founded the predecessor company Claims Services Group (CSG) and was established to serve the Property/Casualty insurance industry’s need for a more efficient way to bring information together to evaluate and settle claims. Since then, Solera has grown into a leading global provider of integrated vehicle lifecycle and fleet management software, data, and services company with more than 300,000 customers operating in more than 100 countries across six continents. Today, Solera sits at the center of the automotive ecosystem and can identify ways to help customers eliminate inefficiencies by using vast amounts of data collected over several decades. Our scale and investment of significant resources into an integrated suite of solutions means that we now support the entire lifecycle of a vehicle from purchase, underwriting, insurance claims processing, repair, service and maintenance, fleet operations and management, valuation to resale.

Over the past several months, Solera has invested in expanding its AI portfolios. With several acquisitions and partnerships, the company is now a global leader in vehicle lifecycle management by providing asset intelligence that accelerates business success for customers who are the key stakeholders in a large, complex, and highly interconnected automotive ecosystem. In addition to property/casualty insurers, the company also supports repair facilities, original equipment manufacturers, parts suppliers, dealerships, and fleet operations. Most of those customers rely on multiple disparate systems and legacy solutions that were developed internally or sourced by different providers. Solera brings all those complex systems together along with the vast amounts of data that support them in a way that helps improve customers’ business outcomes, increase sales, and enhance the experience of our customers’ clients and end-users.

Solera has created a differentiated experience at a global scale. At Solera, we are innovators and change-makers who go the extra mile in a fast-paced and rapidly changing world, and we intend to continue investing in our products to help accelerate the digitization of the vehicle lifecycle to deliver intelligent, data-driven, mission-critical solutions for our customers.

Company:

Solera

Management:

Darko Dejanovic, CEO

Description:

Solera is a global leader in data, applications and services for insurance and automotive. Founded in 2005, with now more than 300 million annual transactions, Solera is transforming the way insurance and automotive professionals provide value to their customers.