Inflation exceeds 16% in the transportation industry this year, the highest increase in over forty years[i]. The recent railway settlement offering 24% pay raises over the next five years assures rising logistics costs for the foreseeable future.

Rising wages is a natural response to chronic labor shortages. Pay raises are good news for the 7.6 million people currently employed in the U.S. trucking industry, including 3.4 million truck drivers.

Investment to reduce logistics costs and reliance on labor is a natural response to rising wages. Electric vehicles and autonomous driving are game changing technologies that promise to change the logistics industry more in the next decade than in the past fifty years.

Electric vehicles and autonomous driving are just two of many emerging technologies that are transforming logistics operations while improving supply chain flexibility and resiliency. The confluence of cloud, sensor and intelligent technology are speeding deliveries, optimizing asset utilization, improving driver performance, reducing accidents and enhancing fuel efficiency.

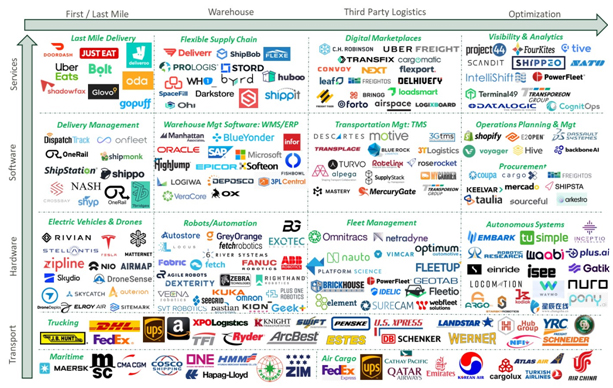

Spurred by supply chain disruptions and a 25% rise in pandemic induced e-commerce spending, the venture industry has invested over $80 billion in over 500 logistics startups since 2010, including $25 billion in 2021 alone. Figure 1 identifies 200 selected venture backed companies that are reengineering the logistics landscape.

Electric Vehicles

Rivianhas emerged as the leader for EV trucks raising $17 billion in 2021, including a $12 billion initial public offering last November. Rivian quietly developed its EV technology for a decade before emerging with $700 million funding from Amazon in 2019. Rivian received a 100,000 vehicle order from Amazon, which is betting that EVs offer a superior last mile delivery option. School and metro buses are shifting to EVs as charging fits well with their daily peak load cyclicality.

Electric vehicles are also unlocking new modes of distribution. Over 150,000 cargo bikes have been sold in Germany and France in the past year integrating with logistics providers to improve last mile delivery efficiency while reducing congestion and emissions in cities.

Autonomous Vehicles

Level 5 autonomous driving has proven more difficult and capital intensive than initially expected. Ford and General Motors have invested billions and announced ambitious plans in 2016 to roll out AVs within five years, yet have delayed launches and raised outside capital to fund continued AV development. Google and Uber have spun off their autonomous initiatives.

Yet autonomous driving startups have raised over $20 billion, and the U.S. government has recently approved production of driverless AVs. The logistics industry has already deployed level 4 AVs for offroad and last mile applications at ports, yards, university campuses and at mines. Initial deployments have shown rapid payback with labor savings and superior safety performance. Recent tests suggest that the trucking industry may also be early adopters for long haul routes. Leading self-driving trucking companies include Plus.ai, Inceptio, Robotic Research, Kodiak and Embark.

Freight Marketplaces

Online marketplaces are replacing freight brokerages as clearinghouses for shippers and carriers. Marketplaces empower small fleet owners and individual truckers with automated bidding systems that enhance shipment visibility and lower transaction costs. Freight marketplaces have raised over $35 billion initially focused on full truckload along major routes and have extended to maritime, air, drayage and last mile. Major freight marketplace startups include Flexport and Forto in maritime, Convoy and Transfix in long haul trucking, Airspace for air cargo, and Next Trucking[i] and Cargomatic for drayage.

On Demand Last Mile Delivery

Mobile marketplaces have captured a 35% share of the burgeoning $38 billion global food delivery market. While last mile delivery is typically a low margin business, online marketplaces have bolstered margins with branded platforms aggregating demand for local food delivery and other services. Startups have raised over $22 billion in this sector, including Doordash, which is now publicly traded with a market cap of $22 billion.

Supply Chain Intelligence

Data lakes can easily become muddy ponds as complex, fragmented supply chains tend to produce dirty data. Walmart, Volkswagen and Nestle each reportedly have over fifty third party logistics providers leaving their customers to contend with a plethora of siloed data. Adding further complexity, producers know their direct suppliers but lack visibility into their myriad indirect suppliers across long value chains.

Supply chains disruptions demand increased intelligence. A recent McKinsey survey indicated that 77% of companies have increased supply chain visibility investments. Venture funding nearly tripled for supply chain visibility solutions in 2021 reaching $6 billion over the past decade. New entries offer supply chain visibility across all components from source of the original supplier. Leading companies in this space include FourKites, Project44 and Shippeo.

Warehouse Robotics: The manufacturing industry automated factories replacing 3.3 employees for each robot installed.[ii]Warehouses require nimbler robots to handle higher variability, yet early pilots have been promising as over 200 warehouses robotics firms crowded the MODEX exhibition floor in March. Options range from full warehouse racking systems from Autostore and Exotec, autonomous mobile robots from GreyOrange and Locus Robotics, robotic pickers from RightHand and PlusOne Robotics, and robot orchestration platforms from SVT Robotics.

Flexible Supply Chain

Supply chain optimization has, for the past three decades, focused on cost and inventory reduction. Logistics is refocusing on flexibility and resiliency as COVID highlighted implicit costs of supply chain rigidity when disruptions occur. McKinsey has found that supply chain disruptions lasting more than one month occur every 3.7 years costing companies about 40% of a year’s profits every decade on average.

Startups have raised over $1.5 billion to create warehouse networks that enable shippers to readily adjust supply chains to changing conditions. Leading flexible supply chain companies include Flexe, Shipbob, Shipmonk and Stord.

Crises indicate that an occasion for retooling has arrived.[iii] Crises destroy bad companies, but good companies survive them, and great companies are improved by them.[iv] COVID and trade realignment have roiled supply chains, but the best companies will emerge stronger through innovation and investment.

[i] Of the companies highlighted in this article, NGP Capital is an investor in Next Trucking, Shippeo and SVT Robotics.

[ii] Acemoglu, D., C. Lelarge, P. Restrepo. 2020. \Competing with Robots: Firm-Level Evidence

from France,” AEA Papers and Proceedings, 110: 383-88.

[iii] Paraphrased from Thomas Kuhn, The Structure of Scientific Revolutions.

[iv] Paraphrased from Andy Grove, Only the Paranoid Survive.