In today’s rapidly evolving financial ecosystem, the infrastructure powering electronic payments must meet the highest standards of speed, security, reliability and scalability. As financial institutions face rising demands from consumers, IBM MQ has emerged as a mission-critical technology for connecting payment applications to powerful networks such as The Clearing House’s Real-Time Payments (RTP) system and the Federal Reserve’s Fedwire network.

Read further to learn how IBM MQ supports these modern payment rails, the technical and operational benefits a messaging infrastructure provides in financial services. Though other payment rails exist that use IBM MQ, such as Zelle or FedNOW, this article’s focus is Fedwire and RTP.

Understanding Modern Payment Rails

The term “Payment Rails” represents the underlying systems and infrastructure used to transfer funds between entities (participants). In the United States, the most prominent USD payment rails include, but not limited to:

- Fedwire Funds Service (Fedwire): Operated by the Federal Reserve Banks, Fedwire is a real-time gross settlement system used for high-value, time-critical payments. It offers immediate finality and is often used for bank-to-bank transfers, securities transactions, and large corporate payments.

- Real-Time Payments (RTP): Launched by The Clearing House in 2017, RTP is the first new payment rail in the U.S. in over 40 years. RTP is gaining adoption due to its speed, lower cost compared to traditional wire transfers.

Fedwire and RTP represent the next evolution of payments innovation for instant transfer of funds and confirmation. Financial institutions, big and small, are offering either or both services to their customers to stay competitive. That said, these Payment Rails demand a robust integration layer to handle secure, high-volume, real-time messaging; and that’s where IBM MQ comes in.

Image Credit: IBM

Image Credit: IBM

What Is IBM MQ?

IBM MQ (Message Queue) is widely regarded as the gold standard for application messaging, particularly within the financial industry. It provides secure, reliable, and asynchronous communication between applications across various platforms and environments. IBM MQ is trusted by global banks and financial service providers for a reason:

- High Performance: Capable of executing millions of transactions per second without compromising integrity and assures exactly-once message delivery.

- Security: Supports SSL and TLS encryption for in-flight or at rest transactions.

- Cross-Platform: Functions across traditional on-premises systems (I.E.: Linux, AIX, Windows, z/OS, IBM i) and modern cloud configurations utilizing Kubernetes (I.E.: Amazon EKS, Azure AKS, Google GKE) or even as a physical appliance!

- Scalability and Resilience: Supports clustered, high-availability deployments for mission-critical operations.

IBM MQ is essential when you need assurance that every message, representing a financial transaction, securely arrives once and once only, in the correct order.

The MQ Advantage for Real-Time Payments

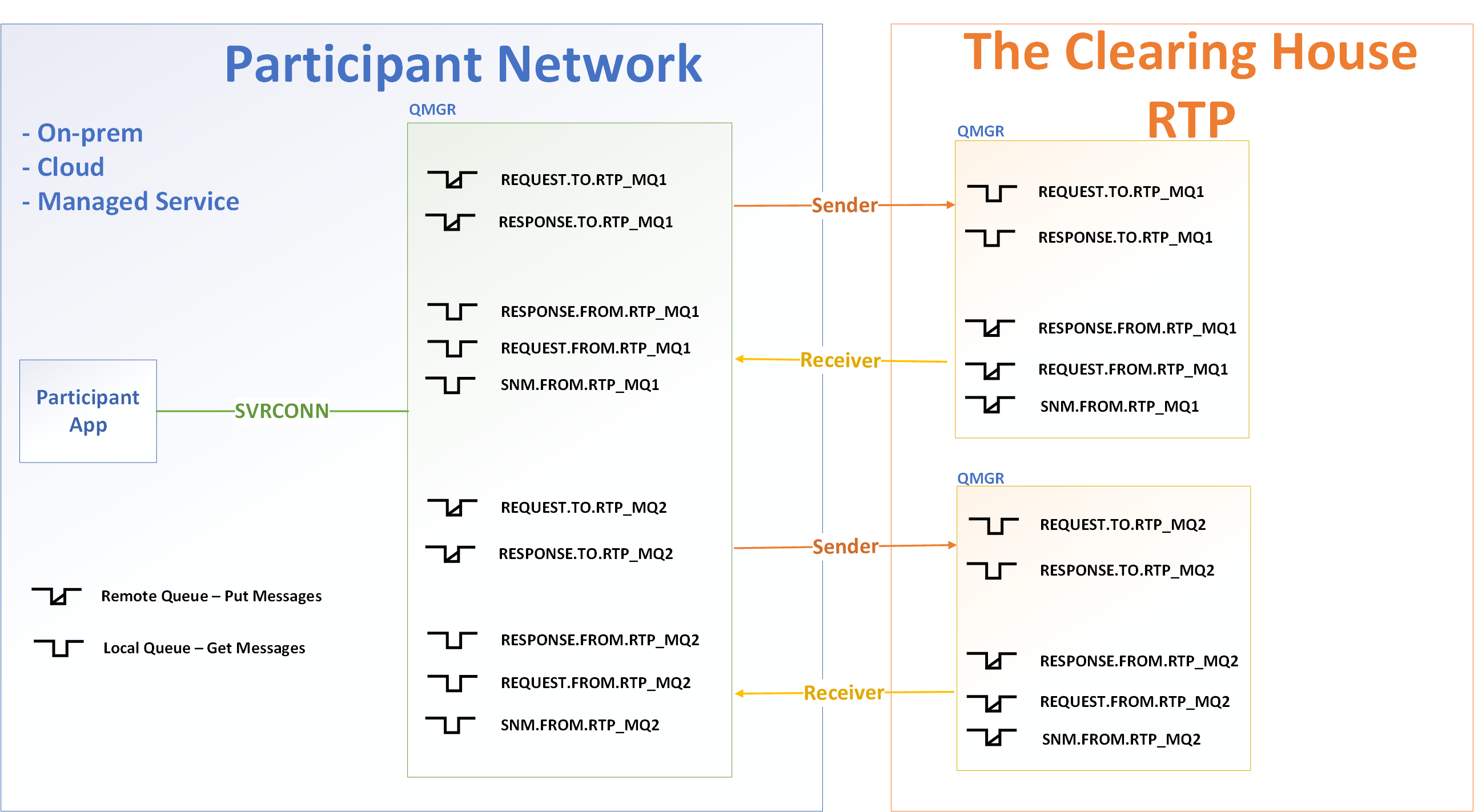

The RTP network is built upon the concept of MQ request/reply messaging pattern. For example, a participant sends a request message following the ISO 20022 standard. These request/reply messages have a short lifespan, and if the message isn’t consumed by the expiry time set, an MQ Expiry Report is generated on the queue property and returned to the participant’s response queue.

The RTP network is built upon the concept of MQ request/reply messaging pattern. For example, a participant sends a request message following the ISO 20022 standard. These request/reply messages have a short lifespan, and if the message isn’t consumed by the expiry time set, an MQ Expiry Report is generated on the queue property and returned to the participant’s response queue.

The overall lifespan of the “transaction” is around 15 seconds, but the “hops” between the participant to RTP to participant and back are 2 seconds each between its respective queue manager. The Clearing House’s RTP documentation provides a chart to explain message expiry further, depending on transaction type.

The RTP queue managers (right side) follow an Active-Active availability, meaning The Clearing House’s two queue managers are always operational. The Participant queue manager (left side) can also be Active-Active or Active-Standy, per datacenter or region.

Though not shown above, Participants use a software defined (logical) network router instead of a physical one.

Finally, the queue managers (Participant and RTP) utilize SSL-TLS certificates from a Certificate Authority (CA) such as Entrust, GoDaddy, etc. These details, as well for the MQ Objects (Queue Names, Channel Names) are part of the on-boarding process when the Participant institution fills out the necessary TCH forms.

Supporting Fedwire with IBM MQ

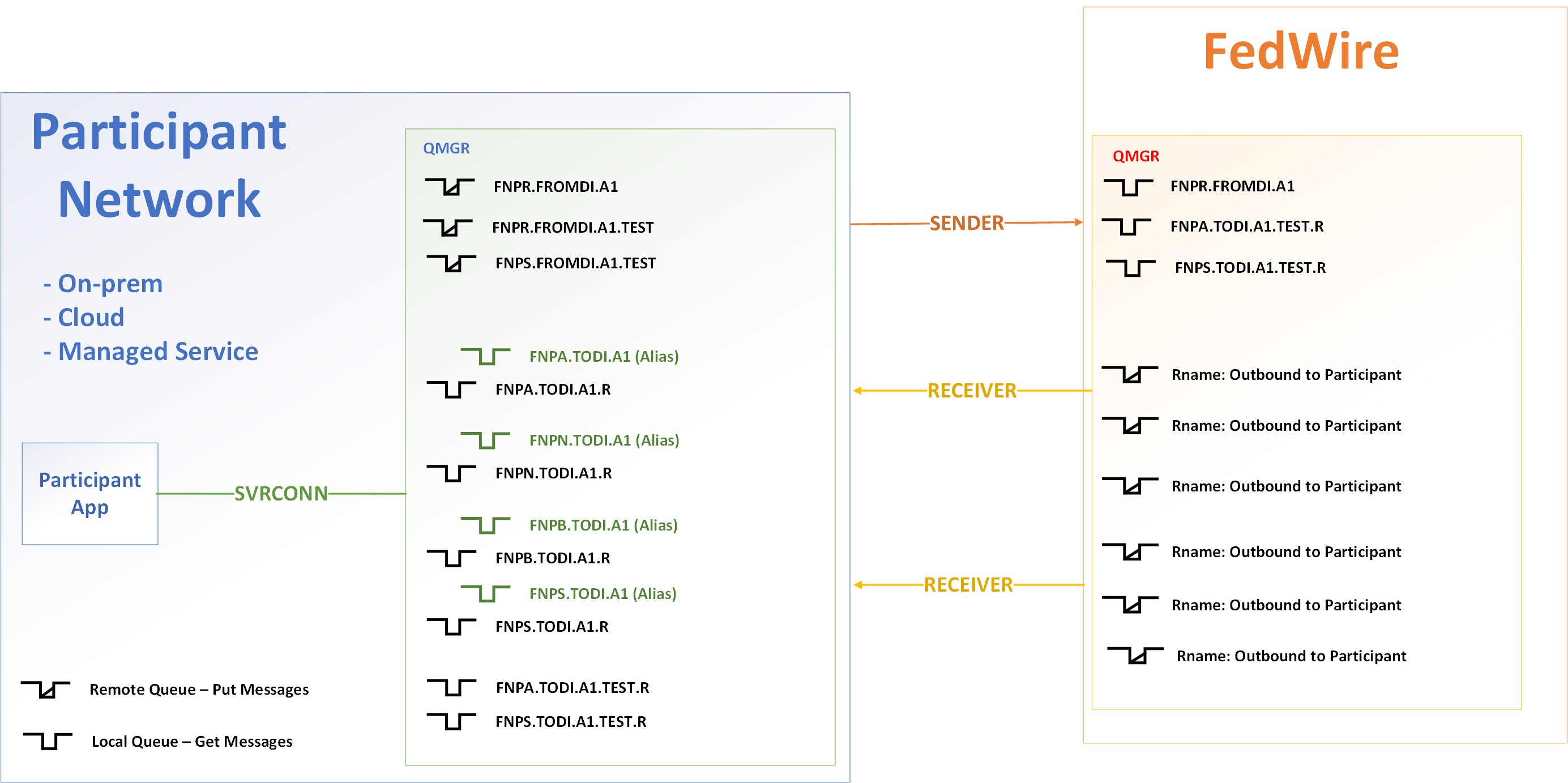

As of this writing, Fedwire uses a proprietary message format called Fedwire Application Interface Manual (FAIM) for sending and receiving messages with Participants, though this format is being phased out in favor of the ISO 20022 standard.

As of this writing, Fedwire uses a proprietary message format called Fedwire Application Interface Manual (FAIM) for sending and receiving messages with Participants, though this format is being phased out in favor of the ISO 20022 standard.

In contrast to RTP, Fedwire messages don’t require expiry to be set. The expectation is that messages persist until they are successfully delivered and processed. Another intriguing difference is the usage of “TEST” queues, even in production; this is in place for diagnosing connectivity issues outside of the core production queues. A final difference to point out is the usage of two receiver channels to Participants. One channel is meant for Fedwire transactions and the other are for account statements.

Though not shown above, Participants use physical network routers meant for two geographically separate data centers. Participants are required to have a DR (or sometimes called a Contingency Site) and validation is performed at least annually with the Fedwire staff.

Finally, the queue managers (Participant and Fedwire) utilize SSL-TLS certificates from the Federal Reserve Banks where they are the CA, interestingly enough. The MQ Objects (Queue Names, Channel Names) are delivered as a series of scripts, called MQSC (Script Commands), including simple shell scripts for unit testing, as part of the on-boarding process when the Participant institution fills out the necessary Fedwire forms.

Looking Ahead

As real-time/high-value payment systems evolve, the role of reliable, secure messaging platforms like IBM MQ becomes even more critical. It’s not just about moving data from point A to point B—it’s about doing so in a way that’s elegant, secure and reliable.

IBM MQ gives financial institutions the ability to keep up with emerging payment methods while maintaining trust and compliance. Whether integrating with The Clearing House’s RTP network or the Federal Reserve’s Fedwire service or any other integration needs, MQ ensures that every transaction meets the high standards expected in the digital financial world.

The future may bring changes in how connections are made and payments are initiated, but one thing remains clear: IBM MQ is here to stay!