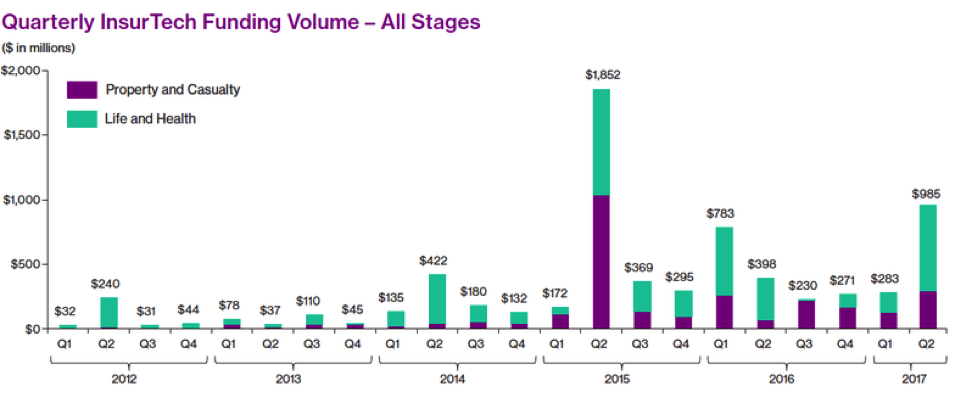

The insurance industry has usually been considered to be highly old-fashioned and slow in terms of adopting innovations. However, the situation has changed significantly with the development of insurtechs – online players dedicated to optimizing insurance and making traditional models on the market more efficient. Insurtech is becoming more widespread – according to the World Insurance Report[1], which features interviews with 103 insurance executives and more than 8,000 customer responses, nearly one third of customers today rely on insurtech solutions, either exclusively or in combination with an established insurance company. Interest among investors is also rising – in the second quarter of 2017 insurance segment observed 248% QoQ growth in funding volume, which reached $985 million.

The first wave of disruption started with online-brokers such as Clark / Knip / GetSafe and the likes being an insurance platform providing transparent and cheap insurance coverage. These companies operate as an app that gives its customers an opportunity to optimize their insurance plans and stay on top of new insurance products. Clark, for example, calls itself an insurance robo-advisor, as it is using algorithms to analyze its customers’ current insurance situation and automatically propose opportunities to improve their coverage.

The first wave of disruption started with online-brokers such as Clark / Knip / GetSafe and the likes being an insurance platform providing transparent and cheap insurance coverage. These companies operate as an app that gives its customers an opportunity to optimize their insurance plans and stay on top of new insurance products. Clark, for example, calls itself an insurance robo-advisor, as it is using algorithms to analyze its customers’ current insurance situation and automatically propose opportunities to improve their coverage.

Although online brokers were able to leapfrog to much more efficient and competitive insurance technologies, these pioneers of insurtech had to face a problem of high customer acquisition cost (CAC), which resulted in low margins of their business and inability to scale substantially (insurance is usually bought once a year and it is thus very hard to market it directly to consumers). High CAC means these companies require a lot of investor money to scale and get to profitability. This problem led to the development of new business models established by disruptors from the second wave of insurtech boom. The main idea behind the new business model was enabling rather than disintermediating brokers (WeFox) or selling insurance using traffic of existing players (Simplesurance). WeFox provides an app for brokers so that they can provide their customers with top-notch service – just like Clark / Knip or GetSafe, but still remain in touch with the customer as well as getting rid of all the hassle associated with settlements and back office that is taken care of by the company. This means better customer service as well as more time to actually sell new policies for the traditional broker who is willing to pay a fee for that service as it enables him to compete with disruptors and offloads settlement and back office work. For WeFox that means higher margins as CAC is much lower – sign up of a broker means getting access to thousands of customers that is more efficient than winning them directly. Simplesurance is another interesting example of lowering CAC. The company started selling insurance policies to protect gadgets at checkout of e-commerce shops and figured out that might be a great customer acquisition tool if you offer a policy for free to those customers who select Simplesurance as a broker. This is a smart way of using someone else traffic to get more business.

However, being a broker is just a half of the deal. Traditional insurance companies are still slow and inefficient and they do not provide tailored made products that fit customers’ needs best. As a result, the third wave of insurance disruptors started with insuretechs receiving insurance licenses and becoming carriers. The examples of such tech companies are Lemonade and One. The first has successfully raised over $60 million in funding since its establishment in 2015 from backers like Sequoia, General Catalyst and Allianz. Lemonade is a licensed insurance carrier that offers homeowners and renters insurance powered by artificial intelligence and behavioral economics. The idea of the company is transforming insurance to «social good rather than necessary evil», as Lemonade aims to donate unclaimed premiums to charity once a year to discourage fraud (in July 2017 Lemonade made its first annual donation of $53,174 equal to 10.2% of first year revenues). Another fully licensed digital insurance carrier is One – the first one in Europe. As the founders of the company claim in the commercial, they tried to find a good insurance company and failed, so decided to create ONE. ONE will develop products that will better cater to the needs of the customer than the existing solutions and be much easier in settlement.

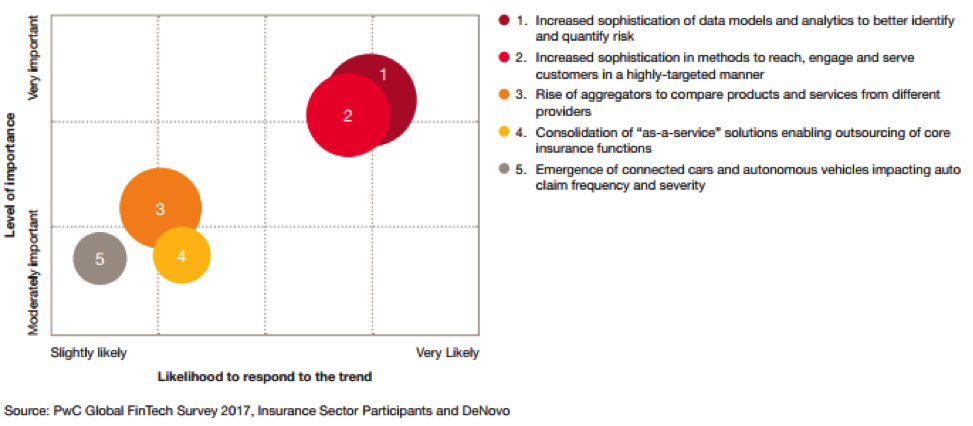

I suppose the next stage for insurtechs is the establishment of platforms offering customized tariffs and tailor made policies for their customers. This hypothesis is supported by the most recent researches – for instance, according to Global InsurTech Report[2] based on the responses of 189 senior insurance sector executives from 40 countries, insurers’ focus has shifted to become more customer centric. Increased sophistication of risk models and higher servicing and customer engagement levels are identified as the most important innovation trends by 94% of respondents taking part in the survey. There are even companies that are already exploiting this trend – UK based Bought By Many crawls internet and social media to identify the unaddressed needs of the customers, pools them in groups and creates policies that suit them better. An example of such policy might be insurance for kittens or African parrots – selling insurance for African parrots may not sound serious enough for an insurance agent wearing a tie, however, Bought By Many proves this is a very viable business case that has to be taken seriously – this is what the market demands and insurance companies should listen.

Another opportunity for insurtechs lies in utilization of big data and adjusting policies based on usage and actual data gathered. This might sound a bit forward looking, but the supporting logic for this is obvious – why should I pay for the time my car is parked at the same rate that I pay when I drive it? The example of insurtech company using the idea of insurance policies tailored to usage is Metromile that raised over $200m from investors including First Round Capital, Index Ventures and Mitsui. Other notable tailored made insurance companies include Next Insurance, which raised a $29 million Series A in May 2017 from investors including Munich Re that customizes insurance plans for business sectors often overlooked by insurers such as personal trainers, photographers or independent contractors. Trov is another player in the field that allows to protect things you care about, be it a bike, guitar or a refrigerator. Looks like a simple and obvious idea, but try to insure your refrigerator with your old school insurance company – that is an exercise!

Another opportunity for insurtechs lies in utilization of big data and adjusting policies based on usage and actual data gathered. This might sound a bit forward looking, but the supporting logic for this is obvious – why should I pay for the time my car is parked at the same rate that I pay when I drive it? The example of insurtech company using the idea of insurance policies tailored to usage is Metromile that raised over $200m from investors including First Round Capital, Index Ventures and Mitsui. Other notable tailored made insurance companies include Next Insurance, which raised a $29 million Series A in May 2017 from investors including Munich Re that customizes insurance plans for business sectors often overlooked by insurers such as personal trainers, photographers or independent contractors. Trov is another player in the field that allows to protect things you care about, be it a bike, guitar or a refrigerator. Looks like a simple and obvious idea, but try to insure your refrigerator with your old school insurance company – that is an exercise!

With more technology around us consumers value comfort and user experience to a greater extent. This forces businesses to change and become customer centric – providing services in a way they are demanded by the customer and not in a way they maximize the profit. This is a fundamental shift and it has already started in insurance industry. With substantial funding insuretechs are on the way to change how the sector looks in 10 years from now.

About the author

Mike Lobanov, General Partner, Target Global

Mike Lobanov, General Partner, Target Global

At Target Global Mike is focused on investments in the Fintech and E-commerce spaces, as well as overall management of the firm. He also manages the relationships with co-investors who join deals alongside Target Global.Before joining Target Global, Mike worked at one of the largest Russian asset manageres, Alfa Capital, where he was responsible for managing $200+ million in assets for Alfa Capital’s 15 largest private clients.Mike holds a bachelor’s degree from the London School of Economics and twice won Russian state competitions in economics and entrepreneurship.