The insurance industry is facing multiple challenges.

The protection gap keeps increasing, insurance operations are still widely inefficient and poorly user centric. Insurers face new risks, behaviors and expectations they need to address.

Climate disruption and digital risks notably keep impacting loss trends. This fundamental undercurrent raises the tide of innovation within the insurance sector. We are only at the beginning of the insurtech movement.

Insurtech 1.0 aimed at disruption and was successful at improving end user experience at enrolment and later, at times of claims. To such an extent that in 2016, 74% of insurance companies surveyed believe their business was at risk of being disrupted by Insurtech[1].

The use of modern technology has greatly improved the user experience. But insurtech remain an insurance business and some players had to learn how to turn an insurance profit. Some did and will keep growing.

That first wave gave way to Insurtech 2.0, turning the threat of disruption into an opportunity for cooperation. Insurtech 2.0 focuses on streamlining insurance operations and refining underwriting profit by unlocking better granularity to uncover pockets of profitable growth notably when facing new risks or poorly understood ones.

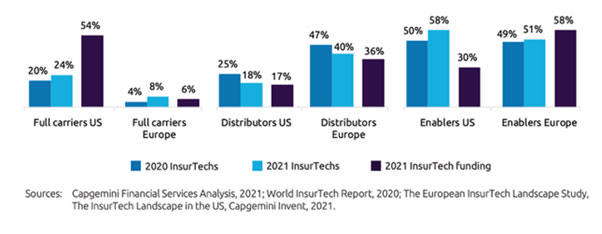

It is evident notably in Europe, where the majority of Insurtechs position themselves as enablers and distributers of incumbents with few full stack carriers (Exhibit 1).

Exhibit 1:

Insurtech 3.0 remains to be defined, starting from the problems to be solved. These can be divided into Internal (Transformation) and External (Innovation).

Insurtech 3.0 remains to be defined, starting from the problems to be solved. These can be divided into Internal (Transformation) and External (Innovation).

INTERNAL DRIVERS

- How to be more efficient

- Automation

- Risk triage for submissions and claims

- Reserve setting, fraud, subrogation, recovery

- How to be more profitable

- Risk analysis and predictive analytics

- Pricing models more granular and complex notably for cat models

- Dynamic pricing

- How to provide better UX at every step of the value chain

- Speed, accuracy, click through, no questions asked

- Personalized

- How to harvest data and harness it effectively for insurance purposes be it top or bottom line

- How to harness the potential of embedded insurance distribution with non-insurance companies

EXTERNAL DRIVERS

- How to be more relevant and meet customer expectations

- How to tackle new risks

- Energy transition

- Climate disruption, carbon and biodiversity loss

- Migration, supply chain and political risks

- Food & resources security

- Digital risks

- Cyber

- AI

- Robotics/Autonomous

- Systemic risks notably for digital, cat and health risks

- How to expand from mere insurance to a more holistic resilience offering orchestrating an ecosystem of partners

- How to adapt to new market conditions

- Cost inflation

- Social inflation

- Omnichannel distribution

- How to answer to market regulation

- ESG

- AI

- Privacy/Security

- Ability to deploy new ways of pricing in filed markets

- How to face competition

Insurance is a system with every component interacting with the next in the value chain. Better UX means better data which requires analytics, which means better technology to harvest and harness it, informing actionable outcome at scale. Personalization means ingesting data from third parties at scale, which requires technology and a solid underwriting engine, possibly algorithmic.

The continuum of data-analytics-business processes-infrastructure, human expertise requires innovation, so back office becomes front office to fulfil an appropriate UX.

Data is merely an ore to be mined. Analytics turns it eventually into gold. IT/Tech infrastructure is needed to dig. But without changing business processes, the precious is not shipped to any client. That is Insurtech 3.0, combining the disruptive promise of Insurtech 1.0 with the enablement of Insurtech 2.0, empowering incumbents to face industry challenges, moving from data-focused to data-driven.

This is why Insurtech can only be described as a movement where no players hold all the cards (open innovation, omnichannel distribution and ecosystem matter).

A changing landscape requires continuous improvement. The days of deploying an IT system and amortizing it over the next 15 years building legacy debt can no longer be the way to sustain profitable growth. The fast pace of innovation and adaptability of Insurtech offers a way forward for incumbents to become more agile with modular, flexible and dynamic solutions.

[1] https://www.pwc.com/gx/en/financial-services/assets/fintech-insurance-report.pdf