We are living in a hyperconnected world, and the presence of IoT devices has already been more pervasive than many of us have realized. Mobile phones in our pockets are full of sensors, their software is updated over-the-air, and when we lose them, we can remotely track their position. The same is happening in all businesses, from simple QR-codes used by restaurants to comply with COVID safety measures, to robots used in warehouses in order to automate certain manual activities.

The insurance sector has to deal with this evolution of society. Some risks are mitigated by IoT solutions, but new risks are also emerging.

Although IoT has not yet been systematically addressed by the large majority of insurers, several early adopters have already concretely demonstrated the potential of using this technology in the insurance sector. I have had the privilege to directly support many of these players through the activity of the IoT Insurance Observatory, an insurance think tank which has aggregated almost 60 insurers, reinsurers and tech players between North America and Europe. Today there are international insurance companies with millions of policies priced with telematics in their auto portfolios, and millions of customers using an IoT-enabled wellbeing reward systems in their life insurance portfolios, and thousands of workers protected with real-time risk mitigation solutions in their workers’ compensation portfolios. The level of maturity is higher on insurance personal lines; however, a new wave of IoT-based initiatives is occurring in commercial lines.

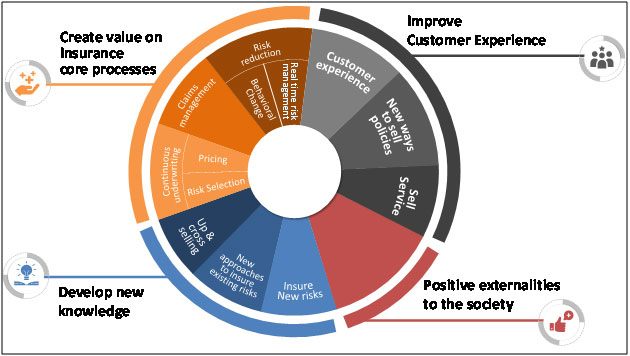

These successful player journeys show IoT’s extraordinary potential to generate value for insurers, policyholders, and even the entire society. Indeed, IoT allows an insurer to connect with its clients and their risks, providing benefits on four axes:

- Improving customer experience by enhancing proximity and interaction frequency with them, therefore moving beyond the traditional risk transfer. Many players are selling additional services for a monthly fee, others have found new ways to sell insurance coverages thanks to IoT;

- Positively impacting core insurance activities (assessing, managing, and transferring risks) by using IoT solutions for continuous underwriting, claims management, and risk reduction. Risk reduction has been achieved by IoT-based real-time risk mitigation solutions, but also by using the insight – generated by the analysis of the flow of IoT data – within structured behavioral change programs in order to promote less risky behaviors;

- Generating new knowledge about policyholders and their risks. This knowledge has allowed to insure current risksin a different way, to enable up and cross-selling actions, as well as to insure new risks;

- Providing positive externalities to society.

Unfortunately, many players in different markets have not understood the strategic nature of this innovation. They have considered IoT adoption as an IT project or the creation of a new product. Instead, IoT’s strategic and transformative nature is one of the key lessons learned from the best practices. IoT adoption is a strategic choice that requires a multi-year commitment to develop the specialistic insurance IoT competencies and the leadership competencies needed to transform the way business is currently being done.

Each of these successful pioneers has designed its vision and strategy for IoT usage within its business processes. As for IoT, a common mistake is the focus on the “thing”, such as smart device. However, you can also hear that IoT is about data, not things. I think thateven this focus on the data isa mistake. What really matters is the usage of the data. The transformation of the business processes – through data usage – has been the secret sauce of any successful IoT insurance program.

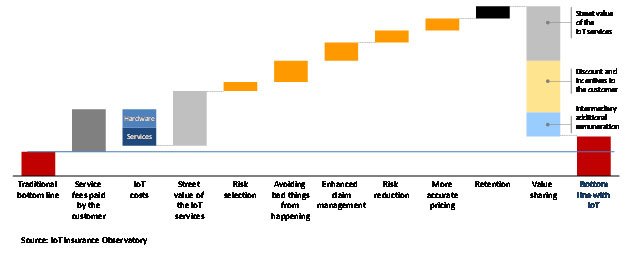

IoT programs not only require investments of time and resources, but they are also add costs – from the hardware to the data management – to the insurance business. Some international success stories – from auto telematics to property insurance for smart commercial buildings – have already shown robust ROI. However, there are not many low-hanging fruits wheresingle use case generates enough value to cover all the emerging IoT costs. Typically, IoT insurance programs need deep functional competencies and a multi-functional approach in order to have multiple use cases which contribute to the return on the technology investment. The opportunities for using IoT data in the insurance sector are summarized by the following framework, which has been developed during the IoT Insurance Observatory editions in the last five years.

This framework represents the broadness and relevancy of potentialIoT applications in the insurance sector. Each of these use cases has been successfully implemented by tens of pioneers in different international markets and in different insurance business lines.

This framework represents the broadness and relevancy of potentialIoT applications in the insurance sector. Each of these use cases has been successfully implemented by tens of pioneers in different international markets and in different insurance business lines.

These use cases don’t change the nature of the insurance business, but they enhance it. Therefore, allowing insurers to do their job better. However, the lens needed to figure out the concrete steps of this business transformation represent a new paradigm. This paradigm requires moving beyond the traditional insurance economics (premiums, claim costs, administrative costs) integrating service fees, partners contributions, benefits generated by the usage of IoT data, IoT costs, and value sharing with policyholders (cashback, discounts, …).

Insurance IoT is a new way of thinking about the activity of assessing, managing, and transferring risks. This new way of thinking for the insurance business fits with a world that is going to be more and more hyperconnected, a trend that insurers canneither stop or ignore.

Insurance IoT is a new way of thinking about the activity of assessing, managing, and transferring risks. This new way of thinking for the insurance business fits with a world that is going to be more and more hyperconnected, a trend that insurers canneither stop or ignore.