Over optimism, the initial requisite for a successful project, is no doubt publicized across the board when it comes to construction tech. Attracting venture capital as the last frontier to be digitalized, representing 14% of global GDP with productivity flatlined, skilled labor shortages, and a myriad of increasing costs, its no wonder a renaissance has begun in construction, but are we ready for launch?

Personally, I believe that most things can be understood through 3 factors, Money; Laziness; and Politics. Focusing in on the financial component below, this article is both an opinion piece to the challenges and opportunities facing ConTech (construction technology) and an invitation towards collaboration to its future. Laziness, while always a factor, we can use the assumption here that the innovations will make it easier for those in the value chain. Lastly, politics, while subjective, the main assumption here is that the digitalization of the industry will make for a more transparent value chain, thus the disconnect between end-user (building tenant), builder, all the way to the raw material suppliers and post-built world will all be forced towards productivity as their value add contributions will be clearly quantified.

An additional caveat of the times regarding Covid-19’s impact on innovation, is simply its increased focus on cash flows. As construction overall is an essential business, and the demand for structures will remain. I’ll explain why I am bullish that with this focus on cash, it is the proper platform to foster innovation in the industry, more in the context of stability (manufacturing construction products in a standardized fashion) and less a statement regarding the openness of capital to fund innovation projects, as this I believe will vary firm to firm and segment by segment.

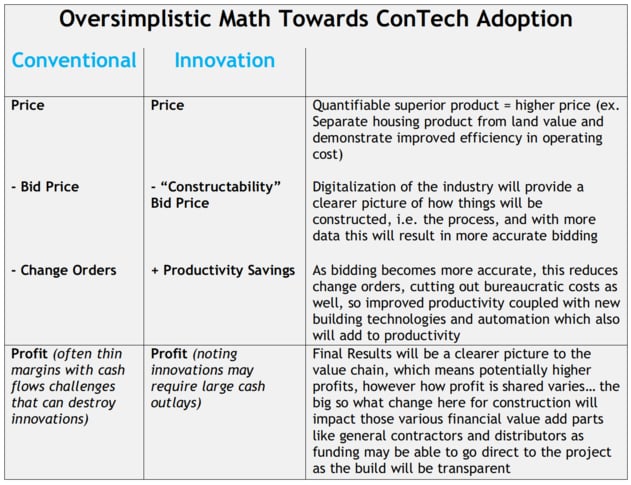

The digitalization of the construction industry is underway and accelerating exponentially, which my oversimplified math equation below highlights several key takeaways to why this decade will be a great time for construction innovation. Breaking the equation into four main parts, Price; Bid Cost; Productivity; and Profit, we can explain how the industry is changing. This analysis is from the project level perspective to a building as a whole with the main assumption that these technological advancements are converging to create a more productive industry. With any disruptions and “savings” there are always incumbents that may lose, for example NY City taxi medallion holders when Uber entered the market.

From the top, Price, which under the conventional model was primarily based on the location, location, location valuation will soon be changing. As the housing product begins to be fully mapped out, the probability that an owner will be able to get a return on investment for choosing premium construction products will become an easier sale. 3D modeling will soon include energy usage calculations, finite analysis, sound characteristics and more. While to some extent this is already in place, like hurricane windows, the future will be holistic in focus. Envision a filter on Zillow that gives the decibel range for the bedroom. Emerging start-ups today are already utilizing block chain technology to begin to catalog and index this information. With all this, I am bullish that by the end of this decade there will be a clear quality score for a home, which will mean a new level of quality for the industry.

The second part of this equation is the Bid cost, which today is basically the tribal knowledge of the builders and those developers buying in bulk. Of course, economies of scale will still provide larger groups a clear advantage, yet the fragmentation of the industry will change with the transparency of integrated systems. Previously, many of the larger firms decided to “self-perform” certain jobs (become more vertically integrated) with divisions that were essentially stand-alone companies. In the near future, we will see this fragmentation become an advantage. With integration (i.e. standardized protocol), the bidding process will allow for more accuracy as concepts like DFMA (Design for manufacturing and assembly) start asking the constructability question much earlier in the construction process. Additionally, this clear index will allow for the adoption of new technologies that can offer partial services like for example automated robotic installations that can’t do the prep and finishing work, yet still offering the industry substantial productivity gains.

The second part of this equation is the Bid cost, which today is basically the tribal knowledge of the builders and those developers buying in bulk. Of course, economies of scale will still provide larger groups a clear advantage, yet the fragmentation of the industry will change with the transparency of integrated systems. Previously, many of the larger firms decided to “self-perform” certain jobs (become more vertically integrated) with divisions that were essentially stand-alone companies. In the near future, we will see this fragmentation become an advantage. With integration (i.e. standardized protocol), the bidding process will allow for more accuracy as concepts like DFMA (Design for manufacturing and assembly) start asking the constructability question much earlier in the construction process. Additionally, this clear index will allow for the adoption of new technologies that can offer partial services like for example automated robotic installations that can’t do the prep and finishing work, yet still offering the industry substantial productivity gains.

Next comes the productivity gains, this will be seen in two main ways, reduction of clerical administrative work, like the reduction of change orders caused by the current bidding process, and second from actual productivity gains as we begin to see augmented and automated solutions from a myriad of start-ups.

Lastly, and the reason everyone goes into business, profit! As universal as profit is as a desire of any business, for the purposes of the above-mentioned items, I believe it is somewhat of a moot point at the holistic level. Some will profit greatly from new technologies making construction productivity, while some incumbents may lose business if their disruption defenses are too low. At the holistic level, my sentiment here is that over the coarse of this decade we will see construction products become increasingly more quantified for their inherent value, customization will become more accessible with technologies like 3D printing, and all this transparency will yield premium products produced in efficient manners, and profit will undoubtedly follow.

Change is coming quick to an industry which has not changed much for too long, meaning it is going to get bumpy, yet I remain optimistic that with technology there is the potential for transparency and with that higher customization and productivity. Construction though is as complicated as any industry, from the mafia to silicon valley, this is an industry many have their eyes on, as profit potential and demand only continue to increase. One major open question still remains how much the industry (or outsiders) will invest in the model below of accepting theoretical savings and immense R&D/prototype costs for a future profit, yet again, I’m bullish on the transparency gains will make these investments less and less risky. Obviously, this short opinion piece does not provide the detail to the complicated and often hidden roles that many in the construction value chain provide, like distributors providing a line of credit to keep sub-contractors installing, this is a very interconnected industry, with a bright future and plenty of room for everyone to grow, so in short to the question of whether construction is ready for launch, my opinion is that we have just left the pad and starting to accelerate.

About the author

Matthew Carli, director of innovation and strategic planning at LATICRETE

Matthew has been with Laticrete since 2013, starting in a holistic development program, as a management trainee, then becoming strategic business development manager. Prior to Laticrete, Matthew was based in Dongguan, China, working as a marketing and sales liaison for an industrial cleaning equipment company.