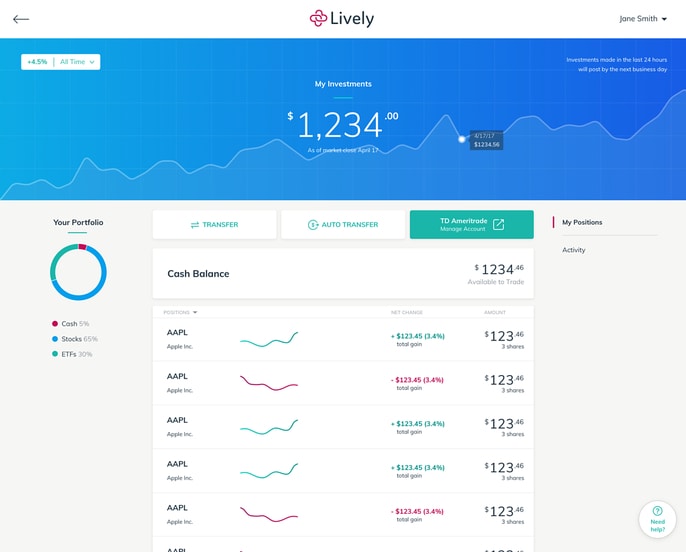

Your health saving plan has revamped. Lively co-founder Shobin Uralil announced the Health saving plan can be now used as an investment vehicle. Apart from covering your healthcare expenses, the Health Saving Plan from Lively has integrated investment capabilities by embedding TD Ameritrade. Good news!! This new feature will be accessible to all Lively HAS holders. The investment options offered with new Lively HSA will be traditional that will grow with the HSA.

Your health saving plan has revamped. Lively co-founder Shobin Uralil announced the Health saving plan can be now used as an investment vehicle. Apart from covering your healthcare expenses, the Health Saving Plan from Lively has integrated investment capabilities by embedding TD Ameritrade. Good news!! This new feature will be accessible to all Lively HAS holders. The investment options offered with new Lively HSA will be traditional that will grow with the HSA.

HSA is a robust and more practical solution to 401(K) as HSA allows you access to your money even before retirement. It grows with the investments and lets you bank upon the accumulated amount anytime. PPO and HMO plans were very popular, but with the rise in trends of HSA, the low-deductible plans do not have many takers.

It is a revolutionary plan, and that has enabled Lively core team to raise $4.2M as financing from investors. The aim of the entire exercise focusses on regulating a high deductible health plan that renders an easy access to the money by account holders. It is a two-way benefit product as it helps the employers and employee too.

The team of experts at Lively is driven by their burning desire to create the most optimized HSA that reassures the account holder that they hold their money. All the effort is dedicated to establishing a seamless HSA that has a robust operational backend and grows with the investment options.