Meta made several announcements at Meta Connect 2022 for products and partnerships that will help to enable the next-generation of Web3 virtual environments. Meta’s announcements were well-aligned with Analysys Mason’s metaverse framework, but there were notable absences in areas where communications service providers (CSPs) can take the lead.

We took away four key points from Meta Connect 2022

Meta Connect 2022 was fundamentally different to last year’s event; Meta focused on establishing its credibility with real-world products and revenue streams and clear market segmentation.

- Meta prioritised making messages understandable and credible for investors. It emphasised the developer revenue success stories in the Quest Store and focused on known verticals with associated dollar values: gaming and enterprise IT. It is looking to provide certainty to investors to gain stability.

- Its partnership with Microsoft adds credibility to its claim that it is aiming for the metaverse to be an open and collaborative ecosystem. Meta announced the porting of Office 365 and Teams to the Quest series, which also helps to strengthen its enterprise IT narrative.

- Meta has now segmented its VR/AR device product lines so that they are clearly aligned to different target segments:

- the Quest headset primarily targets gamers

- the newly announced Quest Pro is primarily aimed at the enterprise market (and secondarily at remote workers and higher-income individuals that spend money on technology)

- Ray-Ban Stories are tailored for AR applications.

- Meta demonstrated its improvements to avatars in order to help capture people’s imaginations and show that not all virtual worlds will necessarily look like Roblox. It presented a photo-realistic avatar using its Instant Avatar technology, though its limited number of facial expressions means that there is more work to do. However, as a prototype, it showed some of what is possible in the near-term. Meta also demonstrated its new Codec Avatar, which is a long way from commercial deployment but showed impressive levels of photorealism.

It will still be a long time until the metaverse becomes as commonplace as other Meta apps such as Facebook, Instagram and WhatsApp, despite the progress shown at Meta Connect. However, momentum is building and we expect that the metaverse or equivalent technologies and ‘worlds’ will become mainstream in the long term (though not within the next 2–3 years).

Meta’s announcements covered six key areas of the meta verse ecosystem

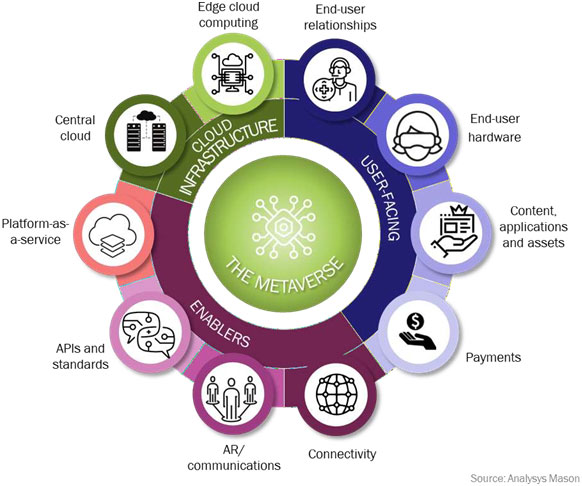

In our report, Metaverse strategies: case studies and analysis, we posit that the various aspects of the metaverse ecosystem can be grouped into three categories and ten sub-categories (Figure 1). No single player needs to excel in all aspects in order to be successful, but Meta has notable activities in almost all sub-categories.

Meta’s keynote contained announcements related to six out of the ten sub-categories.

- End-user relationships. Both Meta’s Horizon Worlds and rival platform Decentraland currently have very few daily active users. However, Meta demonstrated the success of end-user engagement elsewhere in its VR business by announcing that the cumulative spend on the Quest Store since its launch in 2019 was USD1.5 billion, by making a number of Quest gaming announcements and by strengthening its enterprise proposition to demonstrate a new potential market that is metaverse-adjacent, but not based in Horizon Worlds.

- End-user hardware. Meta’s launch of the Quest Pro headset with AR passthrough was central to the Meta Connect 2022 event. Crucially, Meta suggested that this is primarily targeted towards enterprises, with an addressable market of 200 million corporate laptop sales per year.

- Content, applications and assets. Marketplaces are fundamental to the metaverse economy because they will drive customer spend. Meta revealed a number of brand partnerships for its Avatar Store, which it hopes will help to kickstart the sale of portable digital clothing/assets.

- AR/communications. Both Meta and Microsoft (Hololens) have been emphasising mixed reality solutions for enterprises, possibly partly in anticipation of Apple’s much-rumoured AR/MR headset launch (which may take place in 2023). Meta highlighted its partnership with Ray-Ban to develop a lightweight AR headset as well as its newly announced partnership with Microsoft (for Teams integration on the Quest Pro).

- APIs and standards. Meta is focused on basing its vision of the metaverse on open standards and collaboration. Mark Zuckerberg closed his keynote by saying “our role is not just helping to build an open ecosystem but to make sure that the open ecosystem wins out in the next generation of the internet.”

- Platform-as-a-service. This category includes data management, AI and analytics and software development tools that can be used to create the metaverse platform(s) on which metaverse applications run. Engaging developers was a core part of Meta Connect and Meta demonstrated a wide range of tools.

Some of the areas that Meta did not cover in the keynote are where CSPs play a particularly important role

Mark Zuckerberg’s keynote did not include announcements related to cloud infrastructure, connectivity or payments, all of which are important aspects of the ecosystem that will enable the metaverse. They are also areas in which CSPs have strengths. Indeed, we identified two out of three of these categories as priority areas in Metaverse strategies: operators are well-placed to succeed in three specific areas.

Connectivity is a core competency for all CSPs by definition. CSPs’ edge computing capabilities will also be important for the metaverse; edge computing capacity will be necessary in order to make metaverse experiences immersive and real-time. CSPs are establishing edge cloud computing capabilities to satisfy a number of other non-metaverse (particularly enterprise) applications, albeit often using technology supplied by hyperscalers such as AWS. CSPs should investigate how their solutions might support both their own metaverse initiatives and those of other players.

Ultimately, Meta needs to work with CSPs to manifest its vision of the metaverse into reality. All ten sub- categories in the framework in Figure 1 are necessary to enable the functioning of the metaverse economy. This potentially puts CSPs in a position of strength. Both the connectivity and cloud aspects of the metaverse will be explored in forthcoming research in our Fixed Broadband Strategies and Edge and Media Platforms programmes.