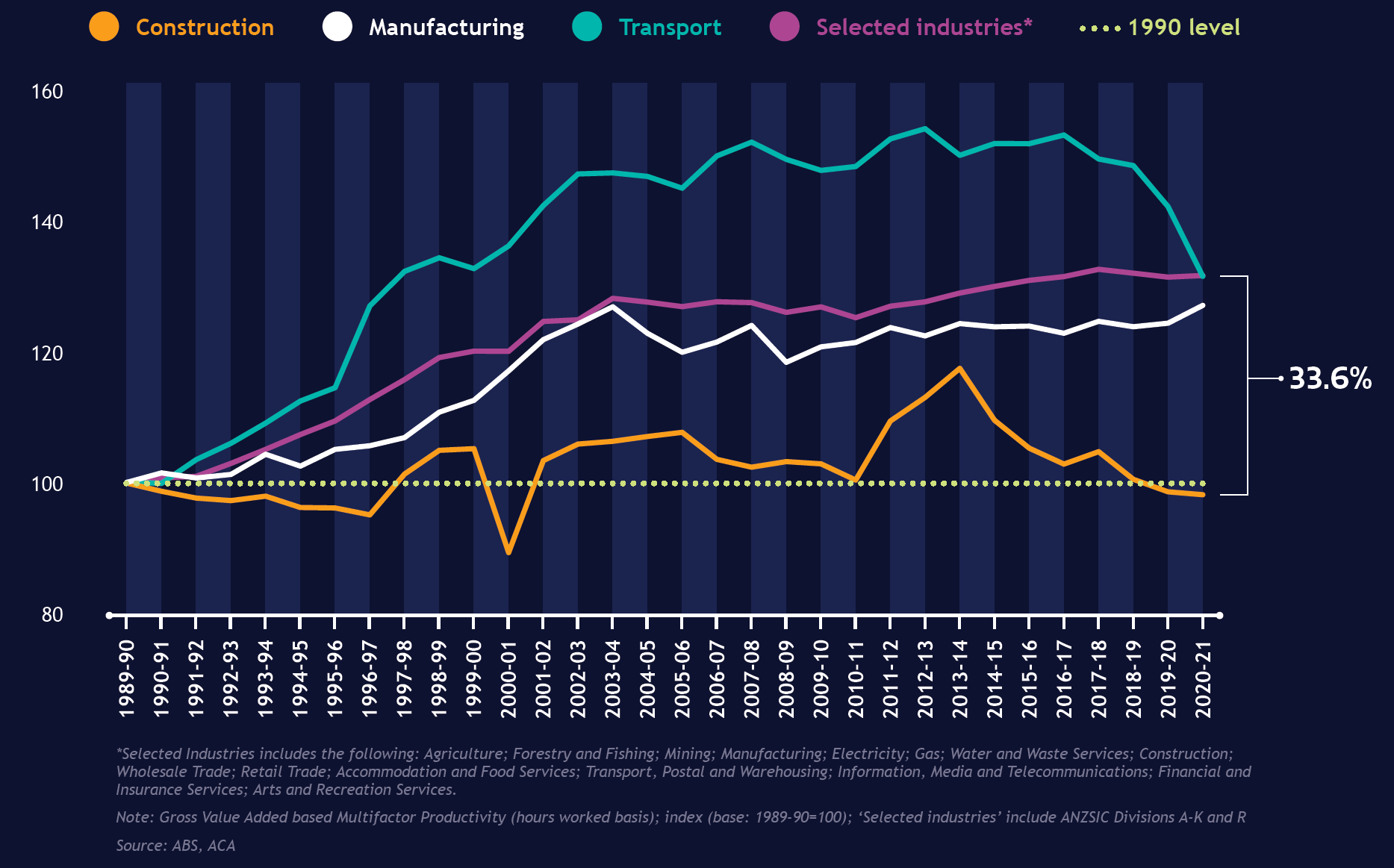

The image below succinctly captures the historic productivity performance of Australia’s Engineering and Construction industry.

Source: ACA, ABS

The Construction sector in particular has performed abysmally, decreasing by a net 1% since 1990 in comparison with Manufacturing and other Selected Industries that have improved by more than 33% over the same time period.

Productivity – defined as the output achieved from given labour, materials and capital equipment inputs – is a very broad measure of industry performance and must be carefully analysed to make sense of year-on-year results.

Over time though, relative change in productivity is widely considered to be an indicator of the health of an industry (as well as a given country for that matter….).

What then drives productivity improvement? Modern industries typically achieve improved outputs from the same input base via enabling technology and improved process efficiency. And increasingly, technological change includes harnessing the power of Artificial Intelligence to augment people and transform organisational processes.

In theory, literally any activity that can be modelled as a process algorithm may be replicated more effectively – read faster and with less process errors – by artificial intelligence.

What then, is holding back Engineering and Construction?

Of course, a great deal of engineering and construction work (particularly infrastructure construction) is undertaken in ever-varying physical conditions, necessitating bespoke solutions that can be constructed without unreasonable disruption to the existing environment.

On the other hand, consider for instance, the number of bodies involved in monitoring the actual digging of a hole, the layers of bureaucracy involved in the current industry version of safety management, or the endless minor design changes often leading to re-work as a defining factor of many projects. One might consider these circumstances as meeting the very definition of low productivity!

There seems then to be some obvious initial targets for AI enabled change. For instance, in estimating where historic data can be harnessed to calibrate job quotes, or in programming and scheduling where knowledge of how to build the job could be automatically converted to Gannt charts. Efficient management and reporting on scope changes and the variations in cost and time (a regular feature of construction) would be a knock-on benefit.

Replacing human leadership and coordination required for construction Project Management is harder to conceptualise, particularly the responsibilities for responding to unexpected challenges and conflicts that draw upon problem-solving and negotiation skills.

It seems then that fundamental change in the industry will be a tough outcome to achieve, a view widely shared according to a recently released PwC global survey of 4702 company CEOs across a range of industries. A quarter of the survey respondents believed their organisations would experience headcount reductions (as a proxy for productivity improvement) of at least 5 per cent over the course of 2024. Most though, ranked engineering and construction firms as least likely to experience AI-enabled organisational change over the course of the coming year.

Does this view reflect doubt in the power of AI to enable transformative change, expectations that our low-margin, feast of famine driven industry will be reluctant to embrace change, or both?

I suspect the latter to be the overriding consideration.

Consider the traditional reluctance of businesses in the construction industry to invest in technology, as widely recognised in a range of publications such as “The Next Normal in Construction” (McKinsey & Company, June 2020) and more recently by “The State of Digital Adoption in Construction” (Deloitte Access Economics, March 2023).

More specifically, consider how much time has passed in implementing 5D “digital twin” modelling from design through to asset maintenance on major construction projects. Key enabling technology promising to revolutionise activities such as construction surveying, identification of underground utility clashes, earthworks management and progress measurement, remains constrained by integration issues across the plethora of systems utilised by supply chains.

Finally, despite the work of Bent Flyvbjerg and others in systematically analysing the performance of projects from a cost and time perspective as captured in “Megaprojects and Risk” (Cambridge, 2003) clients, contractors and sponsors are still routinely surprised when major construction projects overrun budgeted expectations.

What should a proactive organisation be doing right now?

Data-savvy firms with a clear implementation strategy will be at the head of the benefits queue when the AI-enabled change comes.

And to be clear, industry disruption will come.

The sheer size of a $360Bn annual turnover industry employing more than 1 in 10 of our working-age population will demand it.

Peter Wilkinson BE (Mech), FIEAust, EngExec, MBA (AGSM), MAICD is the founder and Director of SamWilko Advisory, where he works with leaders of small-to-medium-sized enterprises, mid-tier, corporate business, and government in the Transport, Construction and Consulting Services sectors. With over thirty years’ experience, he has coached and advised a wide range of enterprises in infrastructure, transportation, mining, defence, utilities, and property industries, both locally and internationally. He is the author of The Steel Ceiling: Achieving Sustainable Growth in Engineering and Construction (Wiley, 2023).